Australian Economy Future Prospects Property Investing

[Blog]

Australian Economy Future Prospects Property Investing

Economy – Future Prospects Navigating economic trends for ADF property investors Understanding the economic outlook For Australian Defence Force (ADF) property investors, understanding the economic outlook is essential to making smart investment decisions. As we write at the end of 2024, the Australian economy is at a crossroads. With a steady inflation – now under […]

Industrial warehouse office conversion

[Blog]

Industrial warehouse office conversion

Industrial Warehouse Office Conversion: Capital Properties HQ on the Sunshine Coast Sunshine Coast HQ enhances work and lifestyle From warehouse to workplace – the commercial conversion that feels like home At Capital Properties, we’re all about creating spaces that support our goals, both in life and in business. Our recent(ish) move to a converted industrial […]

Hot spot suburbs and a FREE RPdata Report Offer

[Blog]

Hot spot suburbs and a FREE RPdata Report Offer

Hot spot suburbs and a FREE RPdata Report Offer Informed property investment for Australian Defence Force members Why you should you invest in hot spot suburbs With the demanding nature of military life, Australian Defence Force (ADF) members often find it challenging to plan for long-term financial success by leveraging opportunities in the property market. […]

ADFA – Yes, it’s time to start building your property portfolio

[Blog]

ADFA – Yes, it’s time to start building your property portfolio

ADFA – Yes, it’s time to start building your property portfolio If your in ADFA don’t wait to build your property portfolio! ADFA – Start your property portfolio now for future financial success As Australian Defence Force Academy (ADFA) members you’re already committed to defining yourself as leaders of the Navy, Army and Air Force. […]

Interest rates – will they drop or keep increasing or stay the same?

[Blog]

Interest rates – will they drop or keep increasing or stay the same?

Interest rates – will they drop or keep increasing? Or stay where they are? What’s happening with interest rates? Inflation and interest rates, and why it matters for property investors In the Statement on Monetary Policy, released by the Reserve Bank of Australia (RBA) in August 2024, the consensus was that “Inflation is still too […]

How does Defence Housing Australia (DHA) stack up?

[Blog]

How does Defence Housing Australia (DHA) stack up?

Who and what is DHA? (I’D BE ASSUMING YOU’D HAVE A GOOD UNDERSTANDING! BUT JUST IN CASE) Defence Housing Australia (DHA) was established in 1988 to provide housing and related services to Australian Defence Force (ADF) members and their families. This includes all members of the Defence Force, Officers and employees of the Department of […]

Goal Setting Strategy The Well Formed Outcome

[Blog]

Goal Setting Strategy The Well Formed Outcome

The Worlds Best Strategic Goal Setting Hack – The Well-Formed Outcome Achieve absolute clarity, create a sense of purpose & fine hone a vision by defining your goals Mastering goal setting – the first step for success Proverb – “Where there is no vision, the people perish” Setting goals is a fundamental step in achieving […]

Home buyer entitlements for Defence members

[Blog]

Home buyer entitlements for Defence members

Federal and state entitlements for Defence Force property buyer Do you know your ADF entitlements? Maximising ADF defence, federal and state entitlements It’s not going to come as a surprise to anyone reading this that there are unique opportunities and entitlements available for members of the Australian Defence Force (ADF). But it’s easy to feel […]

Our ADF Property Investors Case Studies

[Blog]

Our ADF Property Investors Case Studies

Capital Properties – property investment case studies Guiding Australian Defence Force members through strategic property Investments How Capital Properties helps ADF members secure financial independence At Capital Properties, it’s our mission to help Australian Defence Force (ADF) members utilise their disposable income to invest in property and achieve long-term financial independence. Over the years, we’ve […]

Different types of home loans

[Blog]

Different types of home loans

Different types of Property Investor & Owner Occupied home loans Choosing the right home loan for you Everything you need to know about different types of home loans If you’re looking to purchase a home, either for investment or to live in, it’s important to understand the different types of home loans available. In this […]

What you need to qualify for a home loan

[Blog]

What you need to qualify for a home loan

What you need to qualify for an investment property home loan in Australia Do you know if you are ready to apply for that mortgage? Its ok if you don’t – We’ll provide everything you need to know about qualifying for a home loan! Ready to buy your own home or investment property? It pays […]

The Rich Life Concept

[Blog]

The Rich Life Concept

When we first meet many of our Clients, they tell us that the idea of financial freedom feels elusive. With the cost of living as high as it’s been for decades, many people struggle to look at the bigger picture and understand how to make their hard-earned money work well for them. At Capital Properties, […]

Australian Housing Trends

[Blog]

Australian Housing Trends

What’s happening in the Australian property market? If you’re considering investing in the Australian property market, then it’s important that you’re aware of current housing trends. From the ongoing effect of the COVID-19 pandemic, increasing interest rates and the housing crisis, navigating the evolving landscape of real estate in 2024 is best done with the […]

The Right Property Manager

[Blog]

The Right Property Manager

How to help you choose the right Property Manager Find yourself a Property Manager who’ll save you time, money and your sanity! Why you need a good Property Manager We know this isn’t the first time you’ve heard us recommend the services of a Property Manager. In fact, we always recommend you get a Property […]

End/Start of year review

[Blog]

End/Start of year review

Make the most out of the silly season and book your end/start-of-year review with the Capital Properties team ‘Tis the season to be jolly, and what better way to celebrate than by taking a moment to reflect on your property investment strategy with Capital Properties? As the year draws to an end and a new […]

Property investor planner

[Blog]

Property investor planner

Are you ready to take your property investment journey to the next level? At Capital Properties, we understand that achieving success in property investment requires a strategic approach. That’s why we’re excited to introduce you to the Capital Properties Property Investment Planner. This 4-in-1 planner is designed to help you reach your goals of successful […]

Capital Properties Sunshine Coast Headquarters Project

[Blog]

Capital Properties Sunshine Coast Headquarters Project

About this project I’d been keeping an eye on these Industrial Warehouses for a while as we’d often drive past on the way to school drop off. My idea was to do an office conversion! Below are the stages of the build, if you have any questions about this project email

[email protected] We are super […]

Planning your pre-sale property renovation

[Blog]

Planning your pre-sale property renovation

Renovating your home or investment property for maximum return Renovating your home or investment property before putting it on the market is a savvy strategy to maximise the return on your investment. A pre-sale renovation can significantly increase the property’s sale value, attract a wider range of buyers, leave less room for buyer negotiations, and […]

Property Investment 101

[Blog]

Property Investment 101

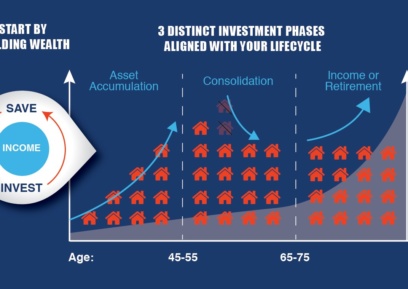

Everything you need to know about property investment in a nutshell It’s been proven time and time again that property investment is a sure-fire method of making the most of your Australian Defence Force (ADF) wages for future financial success. With informed decision-making, a solid understanding of the basics, and a proven investment strategy, property […]

livable house rules

[Blog]

livable house rules

New livable house rules and new design codes Are you on top of the new livable house guidelines? Livable house guidelines Have you heard that the Australian Building Codes Board (ABCB) and National Construction Code (NCC) have recently updated the Livable Housing Guidelines, called ‘NCC 2022’? In fact, the NCC 2022 includes some of the […]

Property Investor Like attracts like

[Blog]

Property Investor Like attracts like

Like attracts like. Success attracts success. How to attract success At Capital Properties we work with Clients every day who thank us for helping them advance their chances at financial success. Many have come to us with little clue of where to start in property investment. Some people have never had the opportunity to ask […]

NSW stamp duty changes

[Blog]

NSW stamp duty changes

Are you keeping up with NSW stamp duty changes? In January 2023, 2 months prior to the NSW elections, both major parties agreed that housing affordability, stamp duty, and tax reform were significant voter issues. So, it’s no surprise that the NSW Premier at the time, Dominic Perrotett (Liberal/National Coalition) announced a key reform ahead […]

OPPORTUNITYISNOWHERE – The sequel

[Blog]

OPPORTUNITYISNOWHERE – The sequel

Interest rates vs Australian property market It’s not much of a stretch to conclude that if you’re reading this post, you’re a switched-on property investor, or on the way to becoming one. And you’ll no doubt be aware that the Reserve Bank of Australia (RBA) has just delivered its 12th rate hike since May last […]

Due for a review?

[Blog]

Due for a review?

Take advantage of the Capital Properties Pinnacle Support Program Are you On Track or off track to meet your goals? So much has changed in the world of finance and property investment in the last couple of years. If you haven’t been keeping up with these changes, you might be missing out on some serious […]

Property Cash Flow or Gearing; Negative, neutral or positive

[Blog]

Property Cash Flow or Gearing; Negative, neutral or positive

What is gearing? In property investment, the term ‘gearing’ describes borrowing money to buy a property. In other words, if you take out a loan to buy a rental property, your investment is geared. Most investors use some gearing – aka, a loan or mortgage, to fund their rental property. Gearing also determines the cashflow of […]

Loan coming off a fixed rate this year? How to prepare..

[Blog]

Loan coming off a fixed rate this year? How to prepare..

Loan coming off a fixed rate this year? How to prepare How to prepare for coming off a fixed rate mortgage As an Australian Defence Force (ADF) member, you should already be clued-up about the importance of having a solid financial plan. Whether you’re new to saving/investing or already have a great Post Defence Force […]

2023 Property Investment Trends

[Blog]

2023 Property Investment Trends

Investing this year / Understanding the trends Understanding property market trends Thinking of investing this year? Understanding the trends in the property market will help you decide if property investment is a viable wealth building strategy for you right now. In this blog post, the Capital Properties experts will examine current market trends that have […]

US Inflation Peaked? What Does That Mean for Australia?

[Blog]

US Inflation Peaked? What Does That Mean for Australia?

Has US inflation peaked? You may have heard talk last year about when and where US inflation would stabilise. Followed by headlines at the beginning of 2023 confirming that US inflation peaked in December 2022. Now, the question economists are trying to answer is how far, and how fast inflation will come down. In this […]

How to Buy Well

[Blog]

How to Buy Well

Are you confident you know how to buy well? Investing in property can be a great way to build wealth over time, but it’s important to make sure you’re buying well. Like any investment, the more you know, the better decisions you will make. With the right guidance, it is possible to make a smart […]

Review your Goals & Financial Vision – What drives you / floats your boat!

[Blog]

Review your Goals & Financial Vision – What drives you / floats your boat!

Securing your financial future Life in the Australian Defence Force can be full of challenges. And we know that it’s easy to get caught up in the busyness of everyday and forget about prioritising your long-term goals. But taking intentional action to secure your financial future as early as possible is a wise move. Being […]

Housing affordability/rental crisis/extremely low vacancies. What does it all mean?

[Blog]

Lifestyle and The Property Decision Making Process

[Blog]

Lifestyle and The Property Decision Making Process

In July 2022, the team at Capital Properties identified that lifestyle had become increasingly important to Aussie home buyers in our blog post: The big shift in Australian demographics. In that post we predicted that this trend would continue to grow, along with a push for eco-friendly builds and green energy. Well, not quite a […]

Will Australian house prices drop this year (Further)?

[Blog]

Will Australian house prices drop this year (Further)?

In this blog post, we’ll examine some of the key factors that are likely to shape the housing market in 2023, and what they could mean for ADF members and their families. Let’s kick off by remembering that the Australian property market had been on a healthy upward trend for the past few years with […]

Property Market Peaking? Inflation? Interest Rates Normalising?

[Blog]

Property Market Peaking? Inflation? Interest Rates Normalising?

Have you been tracking the value of your property recently? You ought to have seen it increasing over the last 18 months. If you’re not sure what your property is currently valued at, then get in touch and we’ll provide you with a desktop valuation within a couple of minutes! We can also prepare the […]

Buying a house while in the defence force

[Blog]

Buying a house while in the defence force

In this blog post, we’ll discuss the nitty-gritty of buying a house in Australia while in the Australian Defence Force (ADF). We’ll include the information you need to take advantage of some loan subsidies and other incentives that are available to you as an ADF member. Want help choosing the right property? Book a discovery […]

10 tips to help you buy your first investment property

[Blog]

10 tips to help you buy your first investment property

It’s no secret that buying a property is one of the best investment decisions that you can make. Property investment is far more predictable than shares or crypto, for example, which can be massively volatile in unstable economic times. Investing in property allows you to benefit from tax advantages while gaining predictable cash flow and […]

Regional Home Guarantee – 5% Deposit Scheme

[Blog]

Regional Home Guarantee – 5% Deposit Scheme

In the 2022 federal budget, the federal government announced a new Regional Home Guarantee (RHG) scheme to boost construction and help homebuyers get onto the property ladder sooner in regional/rural areas. Let’s take a closer look at the Regional Home Guarantee – 5% Deposit Scheme and see what it might mean for you. Need help […]

What is the relationship between inflation and interest rates?

[Blog]

What is the relationship between inflation and interest rates?

We’re all reeling at the price of lettuce and the extra expense at the petrol bowser these days. The news tells us it’s due to inflation. So, what exactly does that mean? What is inflation? What are inflationary pressures? Why is inflation so high right now? Do interest rates rise with inflation? Why does inflation […]

Change of government – Property update

[Blog]

Change of government – Property update

We’re sure you’ll already be aware that the 2022 Australian Federal election brought a change of government in Australia with the Liberal/National coalition ousted, and a majority Labor government sworn in for the first time since 2007. This changing of the guard comes during an escalating war in Ukraine, China’s increasing presence in the South […]

Cash flow property – How to counter interest rate raises

[Blog]

Cash flow property – How to counter interest rate raises

In its first back-to-back hike in 12 years, the Reserve Bank of Australia (RBA) has raised the cash rate by a total of 85 basis points. Its aim is to ease the country off the emergency borrowing settings that were required to maintain the economy through the Covid-19 pandemic. Philip Lowe, RBA Governor said that […]

Your Property Buyer Checklist

[Blog]

Your Property Buyer Checklist

When you’re searching for property, finding the ideal house or block of land can feel all consuming. Many of our clients tell us that they spend an exorbitant amount of time on realestate.com.au without ever finding anything suitable. A lot of that time online is fruitless when you don’t know exactly what you’re looking for. […]

Victorian Windfall Gains Tax

[Blog]

Victorian Windfall Gains Tax

Victorian upper house passes the Windfall Gains Tax. What does this mean for land and property costs? The Windfall Gains Tax (WGT) was first announced by the Victorian government in May 2021. On 20th November the ‘Windfall Gains Tax and State Taxation and Other Acts Further Amendment Bill 2021’ was passed into Parliament. The WGT is […]

APRA Lending Changes

[Blog]

APRA Lending Changes

Have you heard about the most recent APRA lending changes? On Wednesday 6th October 2021, the Australian Prudential Regulation Authority (APRA) sent a letter to all authorised deposit-taking institutions (ADIs) – that includes banks, building societies and credit unions – to advise them of changes to mortgage serviceability buffers. This letter stated that the minimum interest […]

NDIS. What is it? And what do you need to know about it?

[Blog]

NDIS. What is it? And what do you need to know about it?

The National Disability Insurance Scheme or ‘NDIS’ is an Australian Government program that funds costs associated with disability. It was legislated in 2013 and went into full operation in 2020. You probably already know someone who’s benefiting from it, so what are your chances of making it work for you? Let’s start by saying it’s […]

VIC Shared Equity Scheme

[Blog]

VIC Shared Equity Scheme

What’s the Victorian Homebuyer Fund all about? On the back of a tough couple of years for Victoria, the Victorian Government has launched a new home-buyer fund called the Victorian Homebuyer Fund (VHF). This is essentially a shared equity scheme which allows successful applicants to purchase a property with a minimum deposit of 5%. The […]

Top 6 things to invest in while in the military

[Blog]

Top 6 things to invest in while in the military

Most ADF members are so busy working they don’t have time to focus on other aspects of their life, not to mention long-term planning. Sure, the idea is to work an eight-hour day and then make time for you, but with training, exercises and deployments it sometimes seems impossible get off base. We know, we’ve […]

The finance process for the Defence Force property investor

[Blog]

The finance process for the Defence Force property investor

How important is the finance component to the property buying process? Very. In fact, aside from choosing the right property, in the right location, finance is the most important component to property investment. So, it’s essential to get it right. But nobody’s born knowing this stuff. And many financial institutions seem to love making the […]

The Big Shift towards the ideal Australian lifestyle

[Blog]

The Big Shift towards the ideal Australian lifestyle

Question: What does a sea change, tree change and smashed avo have in common? Answer: A bloke by the name of Bernard Salt. Question: Is it important to understand and interpret demographic data when purchasing property? Answer: Yes. Question: Are the 2 questions above in any way related? Answer: Absolutely. And if you’re interested in […]

Building Supplies Property Investor Market Update

[Blog]

Building Supplies Property Investor Market Update

Have you heard that building costs are on the rise? And we’re not talking the usual inflation here, costs have significantly increased since this time last year. You may be wondering why? And if you’re an investor, you’re probably also considering what impact it’ll have on the property market. You certainly won’t be the only […]

Desktop, Kerbside & Full Property Valuations – What’s what?

[Blog]

Desktop, Kerbside & Full Property Valuations – What’s what?

One of the first things you’ll need to do when you’re buying a property, refinancing your home loan or trying to access the equity in your property, is to get a valuation of the asset. This valuation will be used by your lender to make sure they’re lending responsibly. Your bank/lender needs to make sure that […]

Rinse and Repeat Your Property Investor Trade Craft

[Blog]

Rinse and Repeat Your Property Investor Trade Craft

The Capital Properties Pinnacle Program – Property Investor Review Capital Properties’ 7 step process to successful property investment recognises that in order to master our trade craft, it’s vital for property investors to continuously review where we’re at and what our current, short-term and long-term objectives are. On the go? Here’s 30 seconds of take […]

What the heck’s going on in the property market?

[Blog]

What the heck’s going on in the property market?

Wow! What a crazy last 6 to 9 months it’s been! Could anyone have predicted the current market events? Yep, we kinda did! And we’ve got a lot of grateful clients who followed our guidance and have fared exceedingly well, beyond even our high expectations. But if you’re still reeling and wondering what’s going on, […]

Why interstate investment is so hot right now

[Blog]

Why interstate investment is so hot right now

Looking to expand your portfolio? Have you considered interstate investment? Australia has always supported a nomadic lifestyle with one of the highest levels of internal migration in the world. In fact, almost 40% of Australians change their address every 5 years. That’s a whopping average of 13 moves in their lifetime! And in the past […]

What’s the deal with risk? How do I deal with it?

[Blog]

What’s the deal with risk? How do I deal with it?

Risk means different things to different people. For example, why do so many people put themselves at potential risk with different sports? I love to go surfing at my local beach. But I know many people are terrified about the thought of going into the water where I surf. I’ve had people question the threat […]

Going once Going twice Gone

[Blog]

Going once Going twice Gone

Been to an auction lately? Then you’ll have heard these words more than ever before. Because right now the property market is seriously hopping! In fact, according to Australia’s leading online property settlement platform, PEXA, there were more than a whopping 60,000 sales settlements recorded in February 2021. Not bad given the effect that the […]

The difference is perspective!

[Blog]

The difference is perspective!

Early 2020 saw some of the foremost Australian property markets in a major upswing, however it wasn’t long before awareness of the pandemic started to become more apparent. Australian media began reporting major property market correction and buyers began to question if it was a good time to buy. It’s not surprising then that many […]

The great interstate migrate

[Blog]

The great interstate migrate

The great interstate migration. The COVID-19 pandemic has affected Australia and the rest of the world significantly so where we choose to live and therefore our housing markets are also changing. Prior to the pandemic, the growth of Australia’s largest cities including Brisbane, Melbourne and Sydney, was fueled mostly by immigration from overseas as well […]

Crumb’s!? My Property is Close to Handover. What’s Next?

[Blog]

Crumb’s!? My Property is Close to Handover. What’s Next?

So, you’re building your investment property or owner-occupier home and the construction’s been ticking along nicely. Then all of a sudden, you check your email and BANG! You see the Practical Completion Invoice! For some this may be a long-awaited announcement, but it might catch others a little by surprise. No matter how ready you […]

Have you heard about the 5% Deposit Scheme?

[Blog]

Have you heard about the 5% Deposit Scheme?

If not…listen up! You might not think it, but the Australian Government is actively committed to helping younger generations to achieve the great Australian dream of home ownership. And this commitment means constantly thinking of new ways to make it happen. We call one of these schemes “The 5% Deposit Scheme.” Formally known as: The […]

To solar or not to solar, that is the question!

[Blog]

To solar or not to solar, that is the question!

Solar power is a great, clean way to power your home and your investment property. With solar energy you can reduce your dependency on high-priced electricity while you simultaneously reduce your carbon footprint. Here at Capital Properties, we’re all for reducing our carbon footprint. We’ve written about how we try and make our lives more […]

The Defence Force First Home Buyers Guide

[Blog]

The Defence Force First Home Buyers Guide

Are you ready to make your move? The Government introduced the First Home-Owner Grant (FHOG) in July 2000. The idea was to offset the effect of Goods & Services Tax (GST) on property purchases. Each state and territory administered the grants under their own legislation, but the principle remains the same nationally – allowing eligible […]

Yay! My property settled. Now what?

[Blog]

Yay! My property settled. Now what?

Congratulations. If you just purchased a block of land and have settled, then it’s time to celebrate! But don’t too carried too away, because there are still some things you need to do to make sure the build goes to plan. Read on as we share some tips to make the next stage of post-settlement […]

Great Government Grant Grab

[Blog]

Great Government Grant Grab

You’d need to have been living under a rock if you haven’t already heard about the new HomeBuilder Grant introduced on the 18th of June 2020. It’s the Governments’ fundamental response to lessen the impact of COVID-19 on the Australian economy. And they’ve made the package very attractive to Defence Force Members. On the go? […]

Why use a building inspector when constructing

[Blog]

Why use a building inspector when constructing

Construction almost completed? Don’t drop the ball now! Here at Capital Properties we make it our mission to help you with every stage of the finance and property investment journey. We hear stories of some poor souls doing all of the hard work only to have something go wrong at the last minute because they weren’t fully […]

Why being finance ready pays dividends

[Blog]

Why being finance ready pays dividends

Are you in the buying zone? One big mistake many investors and home buyers make is looking at deals and properties before they are finance ready. Because if you want to buy a property and you’re not really sure how much you can spend, it’s difficult to know where to look. The best place to […]

Make uncertainty your ally

[Blog]

Make uncertainty your ally

In uncertain times we can turn to fear, we can shut down and freeze. Or we can see possibilities and opportunities. It all comes down to cultivating the right mindset. On the go? Here’s 30 seconds of take outs: Uncertainty is the only certain thing in life. How we respond to it and the decisions […]

OPPORTUNITYISNOWHERE

[Blog]

OPPORTUNITYISNOWHERE

There’s no denying the impact that COVID-19 has had on stock markets and property markets. But what does this mean for property investors? Is there opportunity to be found in our current situation? In this article we take a look at how COVID-19 compares to previous market downturns and consider exactly what impact it may […]

Hey property investor have you id’d?

[Blog]

Hey property investor have you id’d?

Research is one of the biggest, and most important, parts or your property investment journey. But finding credible, reliable information that’s easy to interpret can be tough. Today we’re sharing with you our go-to source for all your demographic insights. And the best part? It’s completely free. On the go? Here’s 30 seconds of take […]

The One Property After the Other Myth

[Blog]

The One Property After the Other Myth

If you go to property investment seminars, read those ‘1 to 100’ books and follow enough so called ‘experts’ you might start to believe the property game is all about buying one property after another until you’re wealthy enough to retire. And look, I’m not saying it can’t be done. But lots of investors we initially chat with […]

What’s the reason behind the reason?

[Blog]

What’s the reason behind the reason?

Why are you investing? What is your vision for your life and how does investing in property help you achieve it? Thinking about your why and mapping out a vision for your life could be the driving force, the key to unlocking your success. On the go? Here’s 30 seconds of take outs: Many first-time […]

Forward registration land titles

[Blog]

Forward registration land titles

Exchange contracts now settle later! Small deposit required (Typically 5 – 10 % of the land purchase price or less) to lock the contract price of the land and contract build price for a delayed settlement. Sound interesting? What’s the difference between a property title and deed? What’s the difference between an untitled and titled […]

Due for a review?

[Blog]

Due for a review?

When was the last time you checked in on your property investment and long term financial and lifestyle goals? Are you on track? Do you know what you need to do to take the next best step? Let us help you take stock and make smart decisions for now and for the long-term. On the […]

How I first started

[Blog]

How I first started

I’ve been in the property investment market for most of my life. It all started when I turned 17 years old and joined the Australian Defence Force. On the go? Here’s 30 seconds of take outs: I joined the Defence Force at 17 years old in June of 1996. From my first regular wage I […]

How to set up an equity loan for your investment property

[Blog]

How to set up an equity loan for your investment property

Growing a property portfolio to fund your lifestyle goals (and give your parents bragging rights…) requires regular review of your financial position and investment artillery. Find out what to look for and how to arrange a property valuation to help you set up your equity loan. On the go? Here’s 30 seconds of take outs: […]

Why being in the Defence Force puts you on top of a mountain of opportunity

[Blog]

Why being in the Defence Force puts you on top of a mountain of opportunity

If I had a dollar for the number of times, I heard a Defence Force veteran say, “geez Marcus, I wish I’d started sooner!” Well, let’s just say I’d have more than a few extra dollars. But seriously, I believe that Defence Force property investors have an unfair advance when it comes to getting ahead […]

Should I invest in an old property or a new one? Finding the balance

[Blog, News]

Should I invest in an old property or a new one? Finding the balance

Old or new build? How to decide what’s best for you In this blog, Capital Properties experts tackle the question: “Should I invest in an old property or buy new?” Finding the balance is essential for great long-term outcomes. Our mission is to help you become empowered to make a smart investment decision. Deciding whether […]

Ten things when you’re starting out as a property investor

[Blog]

What does it look like to work with Capital Properties

[Blog]

How to determine value when constructing your investment property

[Blog]

What to look for when signing Land and Building Contracts

[Blog]

Double your income

[Blog]

Double your income

Doubling your income might sound like a pipe dream, but with a popular two for one property – the dual key – it’s achievable. Find out why these investments are a great option for Defence Force owner occupiers and investors. On the go? Here’s 30 seconds of take outs: Dual key properties can provide the […]

The 3 things your future investor self should know right now

[Blog]

How to enter the property market without a deposit

[Blog]

The Financial Freedom Myth

[Blog]

The Financial Freedom Myth

Financial freedom is a damaging myth that perpetuates the idea that we should all be striving to escape from our lives through early retirement. Here’s why I think we should be shifting our perspective from financial freedom to financial independence. On the go? Here’s 30 seconds of take outs: Financial freedom is a hot topic, […]

Is now the right time to invest in the property market?

[Blog]

Should I raise the rent? Q&A with the Beau Miller

[Blog]

Should I raise the rent? Q&A with the Beau Miller

When a fixed lease expires on your investment property it can be tricky to decide what to do next. In this blog we take you through the 8 essential questions you need to ask before increasing the rent.

How seasoned property investors avoid analysis paralysis

[Blog]

Dream big to live life large through goal setting

[Blog]

Dream big to live life large through goal setting

As we move to a close this year it is a great opportunity to reflect on how far you’ve come and what you’ve achieved. Then, the stage is set to look forward. It’s what I’m doing right now before New Year’s resolutions are usually made.

Capital gains tax on your investment property with David Shaw

[Blog]

How to build your dream home and lifestyle

[Blog]

Small development project investments

[Blog]

Small development project investments

Surely, you’ve considered a small-scale development project, who hasn’t?! It’s an exciting prospect and the potential upside is better than your standard ‘buy and hold’ strategy.

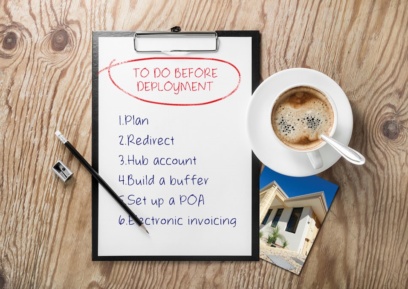

Keep your investments Ship-Shape with this pre-deployment checklist

[Blog]

Tax depreciation reports 101

[Blog]

Tax depreciation reports 101

As a property investor, you could be receiving hundreds or thousands of dollars in tax deductions every year for depreciation on your investment or commercial property.

6 Strategies to keep your investment property(s) working for you

[Blog]

Tips on maintaining your investment property: Interview with Beau Miller

[Blog]

Which national economic indicators sway the property market

[Blog]

Going green and ideas for sustainability

[Blog]

Going green and ideas for sustainability

As a surfer, the ocean plays a huge role in my life. But I’m a bit embarrassed to admit that, in the past, I’ve been naive about the threat that climate change and global warming poses on our oceans and the planet as a whole.

Mind map your way to the lifestyle you want to live

[Blog]

Mind map your way to the lifestyle you want to live

You may well be the most well-read property investor around, but do you know why you’re stepping into the property investment trade? What is it that you want to achieve and how does this align with what you truly value in life?

‘On the level’ connections will move you in more ways than one

[Blog]

How to win in life by kicking a potential sucking habit

[Blog]

Pay off your mortgage faster and enjoy a better lifestyle sooner

[Blog]

10 questions to find the right mortgage broker for you

[Blog]

10 questions to find the right mortgage broker for you

You need to find a mortgage broker with serious nous. A switched on mortgage broker is a key member of your investment support team, that will take the time to understand your goals and find solutions to help you reach them.

How to climb that next step of the property investment ladder

[Blog]

Investing in a good house design makes good investment sense

[Blog]

A changed financial landscape for property investors

[Blog]

How to ease the hurt of a property downturn and keep going

[Blog]

How to get a better valuation on your property

[Blog]

How to get a better valuation on your property

To get the best valuation on your investment property, you need to understand what a valuation is and what criteria a qualified valuer will be assessing. With knowledge under your belt, you can take some simple steps to lift the valuation of your property without over capitalising.

5 top tips to start your savings plan

[Blog]

Casting the net on renovating vs maintenance on your investment property

[Blog]

7 key habits of a successful property investor

[Blog]

Choose your friends wisely and enjoy a rewarding life

[Blog]

The 7 pillars of smart property investing for Defence personnel

[Blog]

A must read: depreciation changes for residential property investors

[Blog]

Online tools to make property investing easier

[Blog]

Hey property investor, how organised are you?

[Blog]

Hey property investor, how organised are you?

The worst thing in the world for a property investor is not to know what is happening with your investment[s]! Get on top of your research and track how your investments are performing, keep up to date on cash flow and and tools to check the property management statements by reading this blog post.

How to build your property investment ‘A-team’

[Blog]

Understanding the benefits and risks of property investment

[Blog]

Getting to know your cash flow: it’s power to you!

[Blog]

How do I make a [re]start with property investing?

[Blog]

Know your alphabet (of first home buyer entitlements)

[Blog]

Are you a property investment flipper or yogi?

[Blog]

Are you a property investment flipper or yogi?

My parents are property flippers. They’ve made it their trade.

They buy a property under market value in a good location that needs a bit of a makeover. They plan and renovate with a goal to list put the property back on the market and turn a healthy quarterly profit.

How to build wealth and enjoy a purposeful life

[Blog]

How to keep your property asset earning you income

[Blog]

How a property depreciation schedule will reduce your tax on your investment property

[Blog]

How to deal with problems with tenants

[Blog]

How to deal with problems with tenants

Effective problem solving smarts is a must when you’re a property investor. If you’ve been in the property trade for a while you will come across problems with tenants that you’ll need to sort out.

Are you getting ready for tax time?

[Blog]

Are you getting ready for tax time?

If you spent your working life, paying tax on your income without looking into legal and ethical tax deduction claims available to you, you may end up handing over almost $1 million to the government.

When is a good time to refinance an investment property loan?

[Blog]

Defence qualities shared by smart investors

[Blog]

Defence qualities shared by smart investors

During my personal experience serving in the Navy, I noticed a strong correlation between the skills and mind sets that the RAN taught me, and those that have seen me succeed in property investment.

How to keep good tenants eager to renew their lease

[Blog]

The story of two young, cashed up Oppo’s in the Puss

[Blog]

The story of two young, cashed up Oppo’s in the Puss

Read this classic tale of two brothers in arms [Oppo's] that end up in vastly different financial positions due to choices made with a decent disposable income. And it’s a tale, not a fable – a true story but names have been changed.

How to choose the right insurances for your investment property

[Blog]

Switched-on-Strategy-Series

[Blog]

How are you tracking toward your lifestyle goals?

[Blog]

Imagination is more important than knowledge

[Blog]

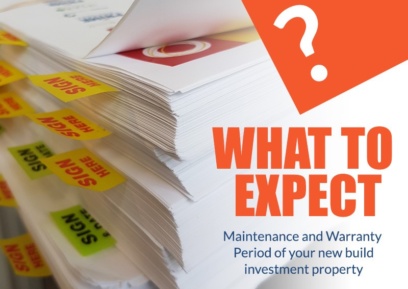

What to expect during the maintenance and warranty period of your new build investment property

[Blog]

Why invest in property?

[Blog]

Why invest in property?

This fantastic nation of opportunity and sunshine is keeping us alive and well for years longer than the generations before us.

So what we do between now and retirement is so important.

How to find quality tenants

[Blog]

How to find quality tenants

Congratulations! You are now a property investing landlord. Now it’s time to make your hard work, build wealth for you. Finding quality tenants will be a big next win!

Leverage, gearing, equity, wealth growing assets. What the..?

[Blog]

How is the year 2030 shaping up for you?

[Blog]

Switched-on Strategy Series

[Blog]

6 Reasons why a new residential build is good for capital growth

[Blog]

10 property investment mistakes I made, so you won’t!

[Blog]

Switched-on Strategy Series

[Blog]

Tax Minimisation Strategies

[Blog]

Tax Minimisation Strategies

On a simple calculation, if you earn $60 000 in 2016 and do nothing about minimising your tax – around $12,000 of your earnings would go to the Australian Taxation Office (ATO) as income tax, including a Medicare levy.

Property investors squash distractions by setting goals

[Blog]